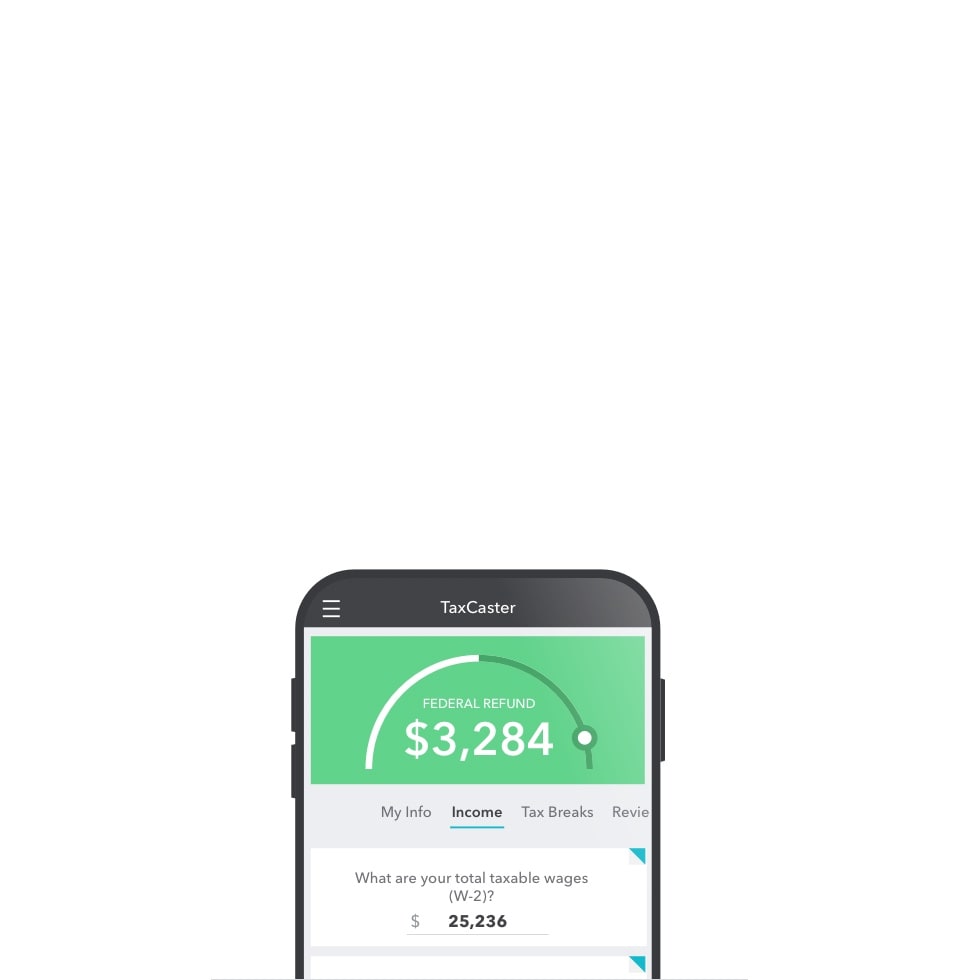

And a third which creates pay stubs Tip Keep in mind, if you compare different Tax Calculators and get different results, it's most likely due to different data being entered by the user In comparison, a higher estimated tax refund does not mean that the estimated results are correct Contact one of our Taxperts and discuss all of your tax questions via your Personal Tax Support pageTax withheld calculators The ATO's tax withheld calculator applies to payments made in the 21–22 income year For information about other changes for the 21–22 income year refer to Tax tables If you employ working holiday makers, other tax tables apply

Free Paycheck Calculator Salary Pay Check Calculator In Usa

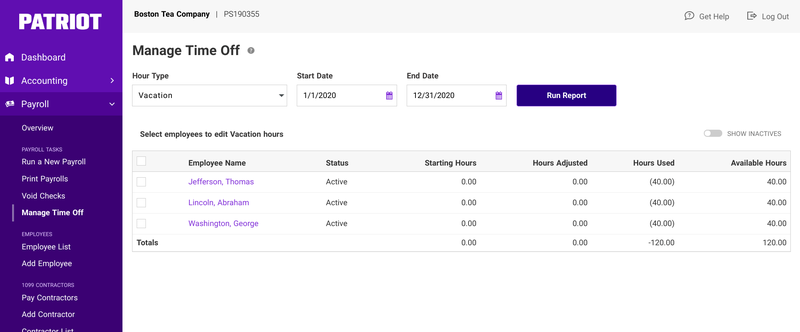

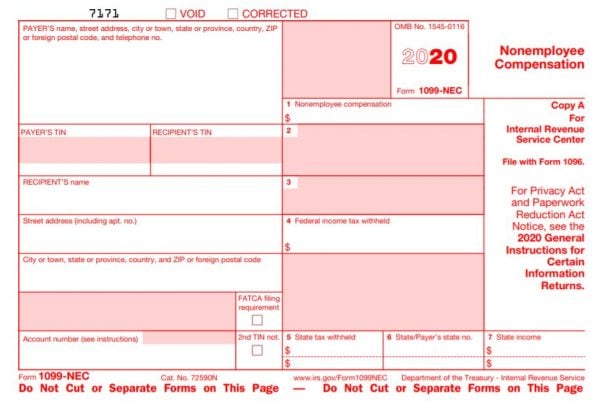

1099 paycheck calculator 2020

1099 paycheck calculator 2020-This calculator provides an estimate of the SelfEmployment tax (Social Security and Medicare), and does not include income tax on the profits that your business made and any other income For a more robust calculation, please use QuickBooks SelfEmployed 18 SelfEmployed Tax CalculatorESmart Paycheck will have extended downtime for system level migration starting on 500 pm PDT This downtime is expected to last until 500 pm PDT If you are unable to connect to the website outside of the expected downtime;

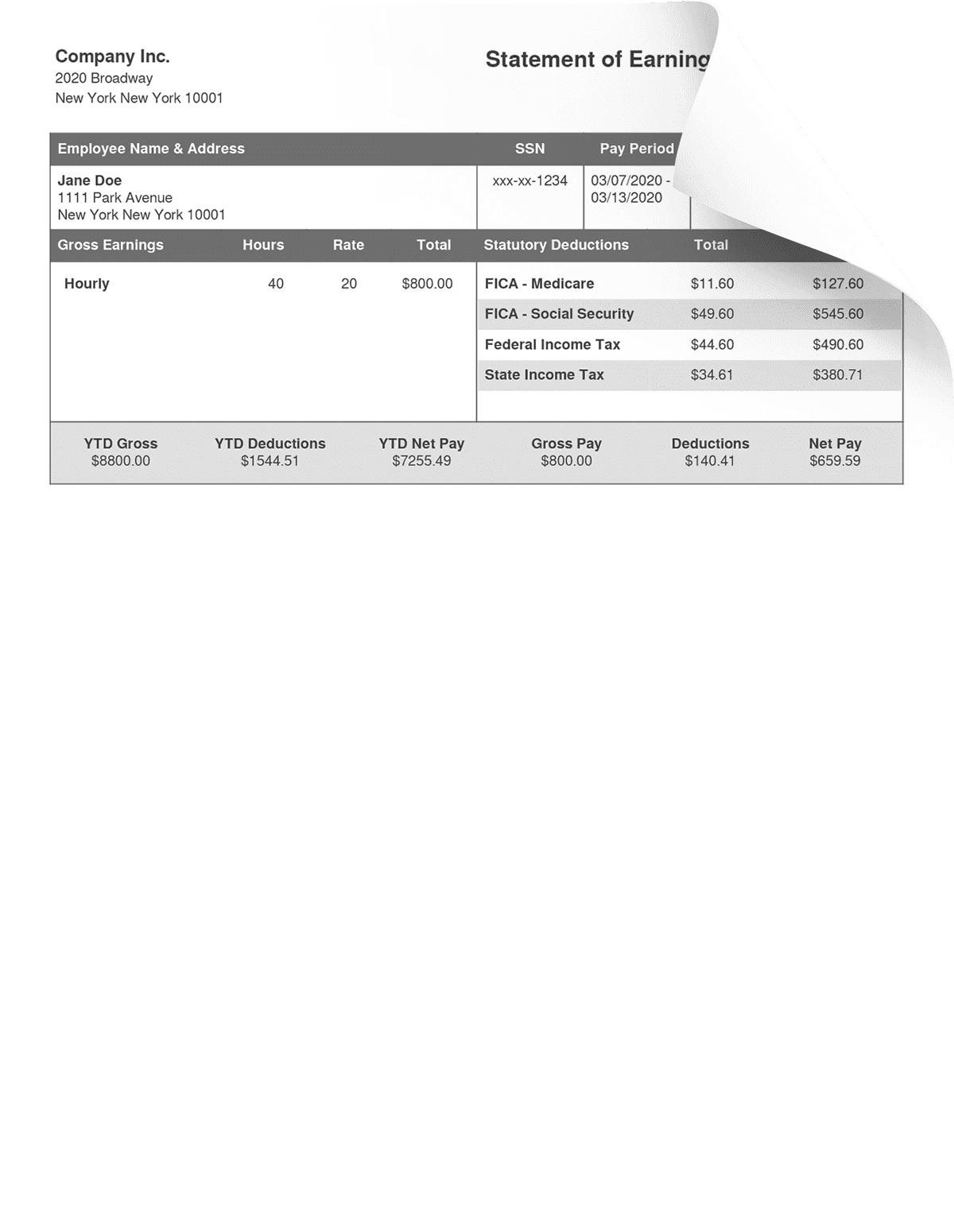

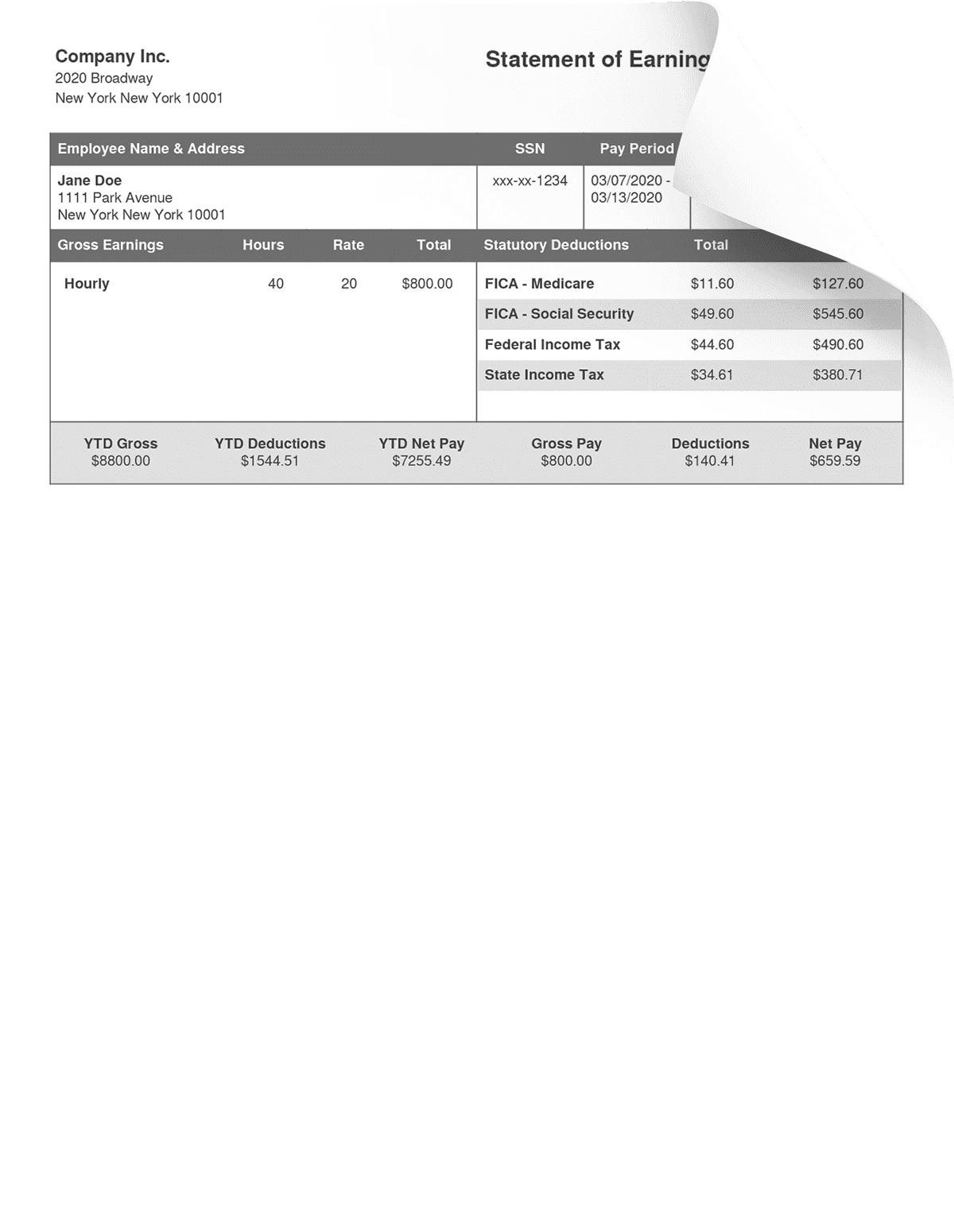

Create Pay Stubs Instantly Generate Check Stubs Form Pros

100% Accurate Calculations Guarantee If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest21 Paycheck Tax Withholding Calculator eFilecom is here to help you optimize your paycheck withholding in 21 to prepare for your 21 tax return Below, use the free tool and enter some figures from your pay or estimated payOur paycheck calculator is a free online service and is available to everyone No personal information is collected This tool has been available since 06 and is visited by over 12,000 unique visitors daily, and has been utilized for numerous purposes Entry is simple

21 tax calculators Stimulus Check Calculator Unemployment Income reported on a 1099G;5021 Calculate your selfemployment 1099 taxes for free with this online calculator from Bonsai Updated for the 21 tax season to ensure accurate resultsThe Freelance Tax Calculator powered by Painless1099 A simple, headachefree, way to calculate 1099 taxes Calculate Your Taxes Looking for our Tax Withholding Product?

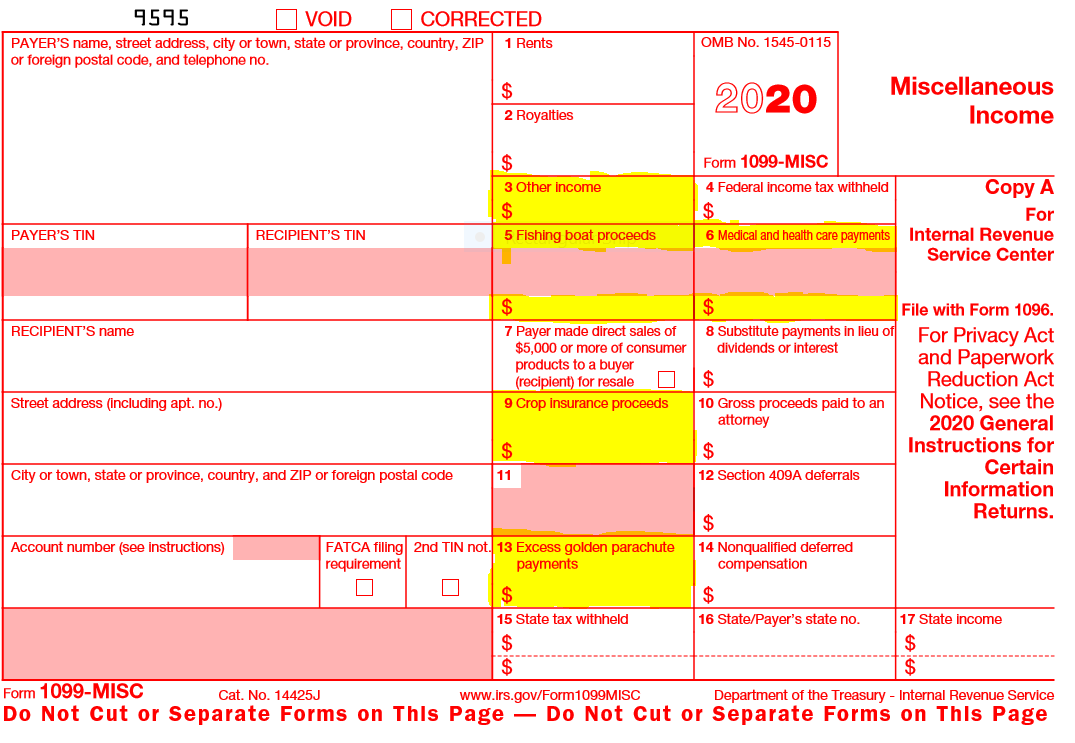

21 tax calculator Enter your Weekly salary and click enter, simple!Paycheck Protection Program (PPP) Loan Calculator Disclaimer The information provided by the SBAcom® PPP Loan Calculator is for illustrative purposes only and accuracy is not guaranteed The values and figures shown are hypothetical, may not be applicable to your individual situation and may not represent the most recent guidance published by the US Small Business You must report the income on your personal tax return and you must pay both income tax and selfemployment tax (Social Security/Medicare) on this income For taxes and beyond, Form 1099NEC now must be used to report payments to nonemployees, including independent contractors Form 1099MISC is now bused to report other types of payments

Free Tax Estimate Excel Spreadsheet For 19 21 Download

Top Ten 1099 Deductions Stride Blog

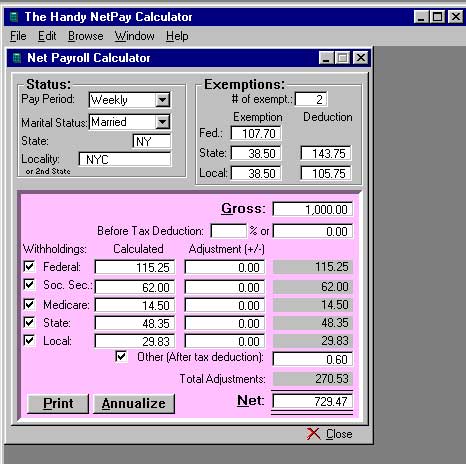

Net Pay Calculator Selection The net pay calculator can be used for estimating taxes and net pay Due to changes to the Federal W4 form in , there are now two versions of the Net Pay Calculator availableUse this SelfEmployment Tax Calculator to estimate your tax bill or refund This tool uses the latest information provided by the IRS including annual changes and those due to tax reform Gather your tax documents including 1099s, business receipts, bank records, invoice payments, and related documents to fill in the drop down sectionsPaycheck Calculator (US) Loop Cupcakes Finance Everyone 6,647 Contains Ads Add to Wishlist It does it by computing a few formulas given by the IRS based on the brackets, it also adds a few extra variables related to social security, medicare, and other federal deductions

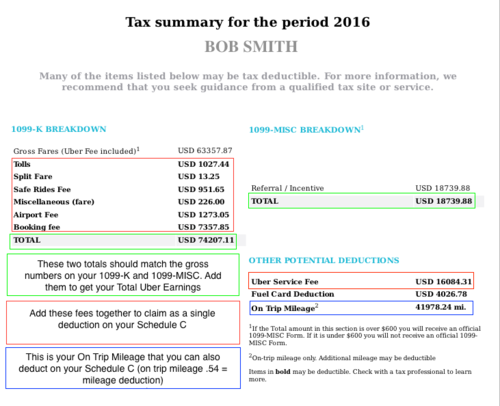

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Is Social Security Taxable Update Smartasset

As of Summer 19, we've discontinued automated banking services for independent contractorsOne which calculates payroll based upon regular and overtime hours worked, as well as sick leave and vacation;Selfemployment tax consists of Social Security and Medicare taxes for individuals who work for themselves Employees who receive a W2 only pay half of the total Social Security (62%) and Medicare (145%) taxes, while their employer is responsible for paying the other half Selfemployed individuals are responsible for paying both portions of

Free Tax Calculator Tax Return Estimator Liberty Tax

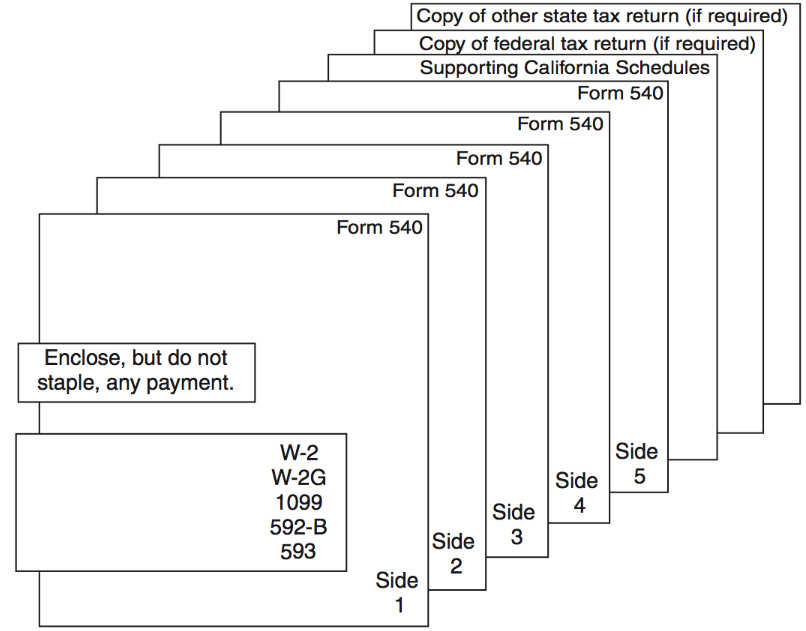

Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

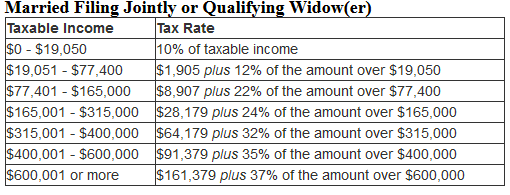

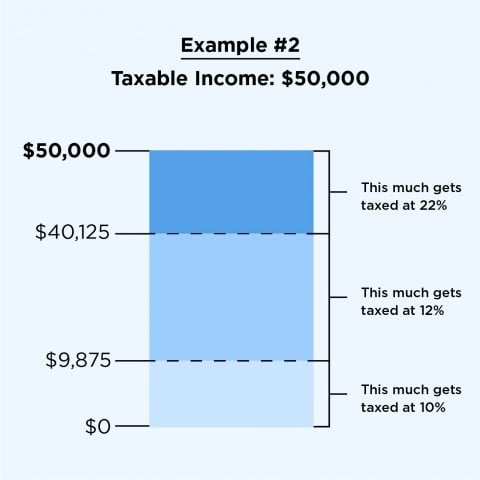

Our calculator can help answer some of your questions as you move into tax season, such as how much you might be expected to pay for your taxes From there, you can reach out to a Pro on our platform to have your taxes handled by a professional — which means less work for you, and a much smoother tax season for your businessUse our Tax Bracket Calculator to answer what tax bracket am I in for your 21 federal income taxes Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate View federal tax rate schedulesUse our selfemployed tax calculator to see how much you'll owe on taxes when you file your 1099, 1099 Tax Calculator A free tool by Everlance Tax filling status Single Married State* How to pay taxes as a 1099 contractor

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

1

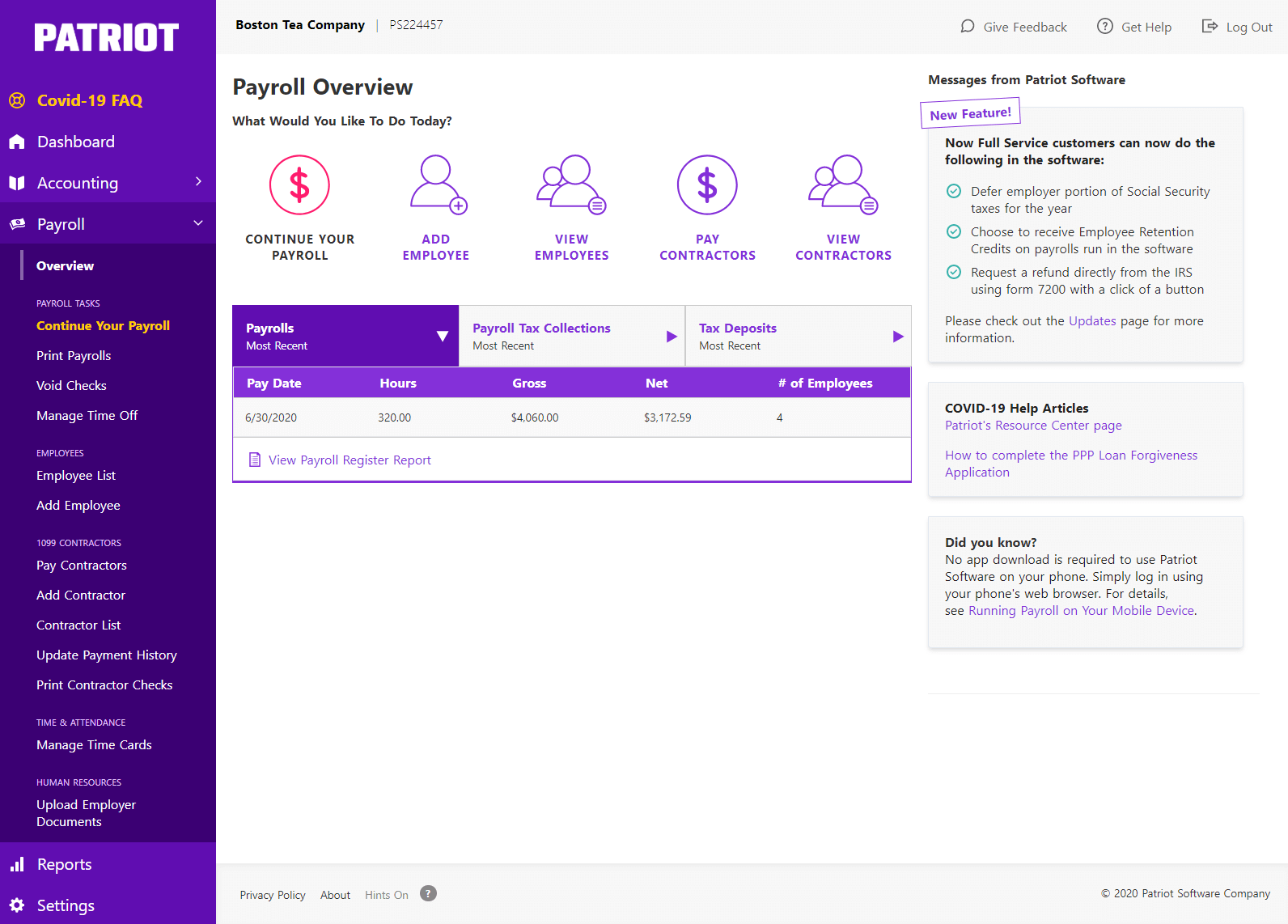

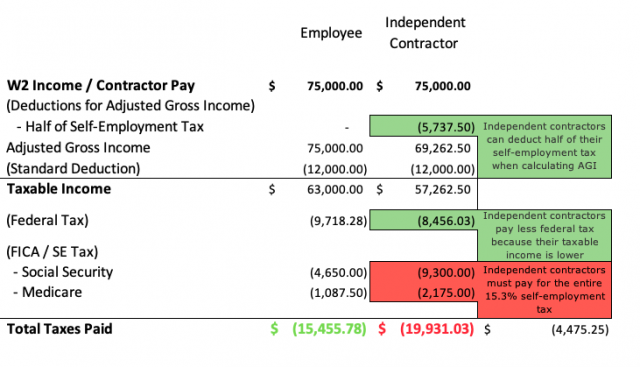

Free Payroll Calculator Flexible, simple payroll tax and deduction calculations Enter hours or salary for tax computations Add overtime, bonus, commission or any earning items Add pretax (401k, eg), nontax (POP) or aftertax deductions Add local tax items as needed Print paystubs or paychecks See DemoUse SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes Overview of North Carolina Taxes The IRS made significant changes to the version of the Form W4Use this calculator to view the numbers side by side and compare your take home income ©17, Lifetime Technology, Inc Compare your income and tax situation when you work as a W2 employee vs 1099 contractor

Self Employed Tax Calculator Independent Contractor Lili Banking

Doordash Tax Calculator 21 What Will I Owe How Bad Will It Hurt

Easy, affordable and reliable payroll, accounting, check printing, and W2 1099 1095 tax software for businesses and accountants Get started with a noobligation free trial today!Paycheck calculators are great tools for both employers and employees For example, the SmartAsset paycheck calculator can help users better understand their take home pay per paycheck The tool works for both salaried and hourly jobs andCalculate taxes you'll need to withhold and additional taxes you'll owe Pay your employees by subtracting taxes (and any other deductions) from employees' earned income Remit taxes to state and federal authorities File quarterly and yearend payroll tax forms Give your employees and contractors W2 and 1099 forms so they can do their

Paycheck Calculator Take Home Pay Calculator

Know Your Income Tax Using A Tax Calculator Business Module Hub

9221 Employee payroll calculator Use this employee payroll template to record your employee payroll and calculate hourly paychecks Three worksheets are included one for employee wage and tax information; Use the form to calculate your gross income on Schedule C Outside of the 1099MISC, you may need to file your estimated taxes quarterly if you will pay more than $1,000 in taxes for the fiscal year All 1099 employees pay a 153% selfemployment tax There are two parts to this tax 124% goes to Social Security and 29% goes to MedicareIncome Tax Calculator Knowing how much you need to save for selfemployment taxes shouldn't be rocket science Our calculator preserves sanity, saves time, and destresses selfemployment taxes in exchange for your email

Free Paycheck Calculator Salary Pay Check Calculator In Usa

Real Time Self Employment Tax Calculations Hurdlr

This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period (weekly, fortnightly or monthly) It can be used for the 13–14 toFree online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors It can also be used to estimate income tax for the coming year for 1040ES filing, planning ahead, or comparison Explore many more calculators on tax, finance, math, fitness, health, and moreIllinois Salary Paycheck Calculator Change state Calculate your Illinois net pay or take home pay by entering your perperiod or annual salary along with the pertinent federal, state, and local W4 information into this free Illinois paycheck calculator See FAQs below State & Date

How To Create An Income Tax Calculator In Excel Youtube

Opers Tax Guide For Benefit Recipients

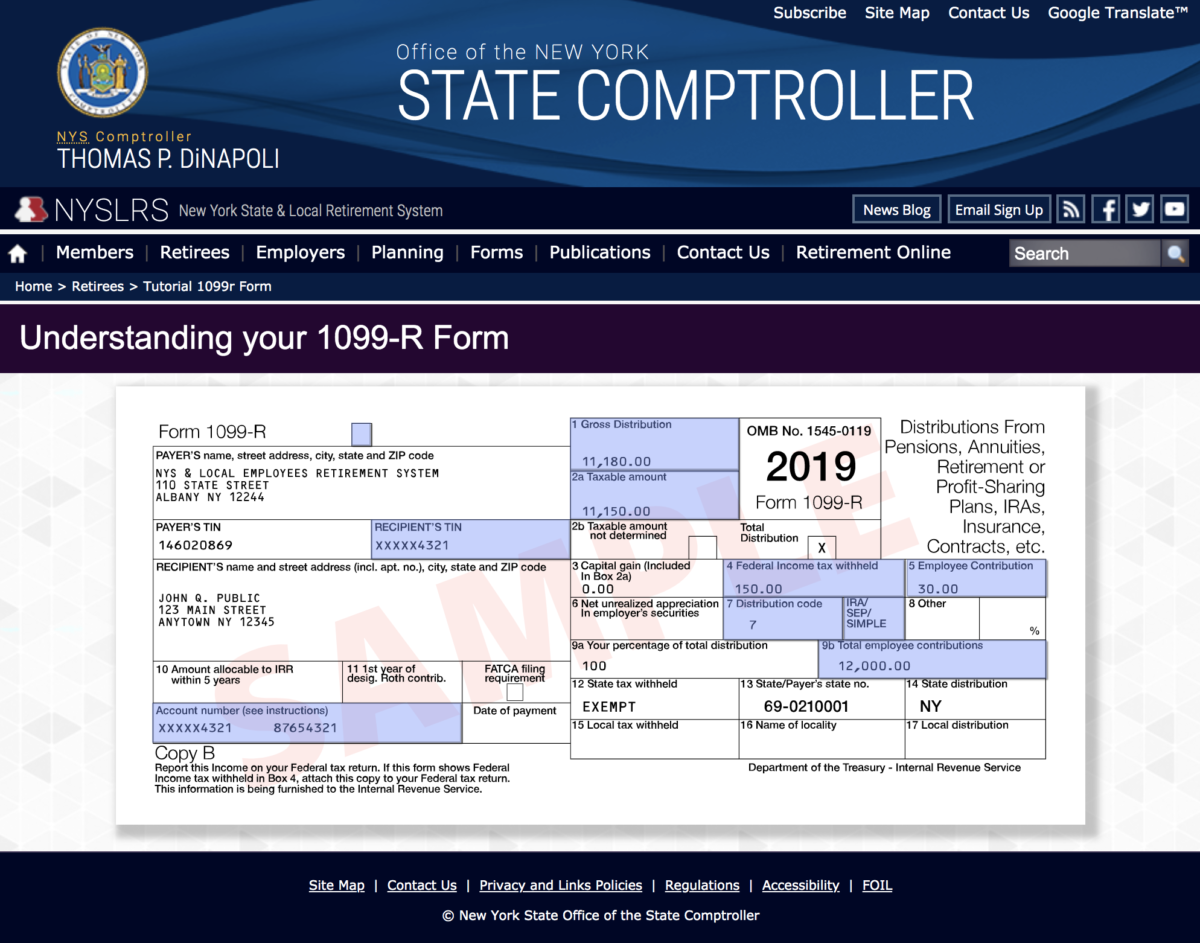

1099NEC Cat No N Nonemployee Compensation Copy A For Internal Revenue "Wages, salaries, tips, etc" of Form 1040, 1040SR, reported on Form 1099MISC for additional tax calculation See the Instructions for Forms 1040 andOur 1099MISC generator is the simplest and the most advanced 1099MISC generator tool you will find online In less than 2 minutes, you can create a 1099MISC form, automatically filled with correct calculations and ready to be sent to your employees Providing your company information, as well as the employee information and wage details is By contrast, 1099 workers need to account for these taxes on their own The selfemployment tax rate for 21 is 153% of your net earnings (124% Social Security tax plus 29% Medicare tax) While the Medicare portion of the tax applies no matter how much you earn, the Social Security portion applies to earnings up to $137,700 for

Q Tbn And9gcs4gdtag4hsgt2l9etrxjj4t6ldmxh9rcosfjsq3ct1ernmqv6r Usqp Cau

Simple Tax Refund Calculator Or Determine If You Ll Owe

185 To calculate your AGI, take your self employed net income and subtract the total SelfEmployment taxes you've paid The IRS allows many deductions below the line that help reduce what you pay This calculator applies the following standard deduction ($12,400 for single filers) and Section 199A (commonly called QBI)2 Calculate your Florida selfemployment 1099 taxes for free with this online calculator from Bonsai Updated for the 21 tax seasonWhether you're a freelancer, 1099 contractor, small business owner, or any other type of selfemployed worker, your independent contractor taxes are going to be a bit more complicated (and maybe even scary!) than you might expect Unlike for salaried jobs, with your filing status, taxes aren't automatically withheld from your selfemployment income pay stubs throughout the year

Self Employed Tax Calculator Independent Contractor Lili Banking

Payroll Tax Calculator California

Salary paycheck calculator guide Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll How to calculate net income Determine taxable income by deducting any pretax contributions to benefits;Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W4 form This calculator is intended for use by US residents The calculation is based on the 21 tax brackets and the new W4, which in , has had its first major Paycheck Calculator Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions, withholdings, federal tax, and allowances on your net takehome pay Unlike most online paycheck calculators, using our spreadsheet will allow you to save your results, see how the calculations are done, and even customize it

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

1099 Vs W 2 Employees The Pros Cons How To Choose

Federal and State Tax calculator for 21 Weekly Tax Calculations with full line by line computations to help you with your tax return in 21 One of a suite of free online calculators provided by the team at iCalculator™ See how we can help improve your knowledge of Math, Physics, Tax, EngineeringAs an independent contractor that makes more than $600, you'll be given a 1099MISC to file If you worked for a company, your employer typically takes money out from your paycheck to set aside for your taxes owed As a 1099 worker, you are solely responsible for handling your taxes (use our 1099 calculator to see how much you owe) A lot of independent contractors are not To alleviate some of your anxiety, we designed a freelance income tax calculator for all types of 1099 workers the selfemployed, independent contractors, and freelancers You can use this calculator to estimate your 1099 income by week, month, quarter, or year by configuring how much and how often you plan to work

9 Amazing 1099 Independent Contractor Tax Deductions Next Insurance

Llc Tax Calculator Definitive Small Business Tax Estimator

Following are the 5 steps to estimate quarterly income tax for 1099 Contractors 1 Determine if You Are Likely to Owe Quarterly Estimated Taxes Anyone who does not have an employer withdrawing enough income taxes to cover all their taxable income is subject to paying quarterly estimated taxes If you are a freelancer or a contractor, you willHow Your Ohio Paycheck Works Calculating your paychecks is tough to do (without a paycheck calculator) because your employer withholds multiple taxes from your pay The calculations are even tougher in a state like Ohio, where there are state and often local income taxes on top of the federal tax withholdingYou will pay an additional 09% Medicare tax on the amount that your annual income exceeds $0,000 for single filers, $250,000 for married filing jointly, and $125,000 married filing separate Use this calculator to estimate your selfemployment taxes This information may help you analyze your financial needs

Esmart Paycheck

21 Federal Income Tax Brackets Tax Rates Nerdwallet

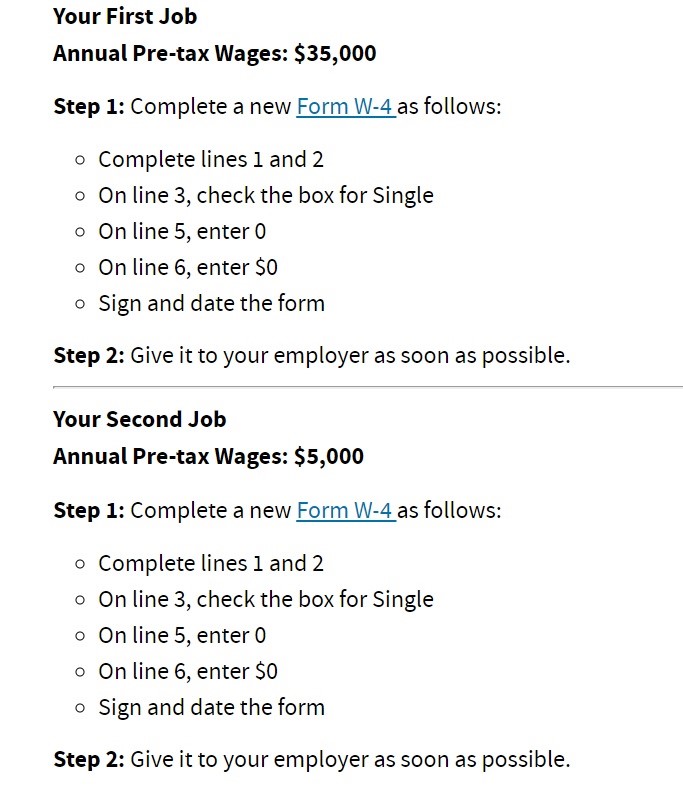

It's up to you to fill out and file Form 1099MISC for every subcontractor you pay more than $600 during the course of the year The deadline for getting a Form 1099MISC to a subcontractor is January 31st, And, as of this current tax filing, all Form 1099MISCs must also be filed with the IRS by January 31stMultiply the hourly wage by the number of hours worked per week Then, multiply that number by the total number of weeks in a year (52) For example, if an employee makes $25 per hour and works 40 hours per week, the annual salary is 25 x 40 x 52 = $52,000 Important Note on the Hourly Paycheck Calculator The calculator on this page is8721 Before You Begin Gather the most recent pay statements for yourself, and if you are married, for your spouse too Gather information for other sources of income you may have Have your most recent income tax return handy Keep in mind that the Tax Withholding Estimator's results will only be as accurate as the information you enter

Free Tax Calculators Money Saving Tools 21 Turbotax Official

What You Need To Know About Instacart 1099 Taxes

1

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)

How Much Should You Budget For Taxes As A Freelancer

Taxation Of Your Benefit Mtrs

How To Calculate Federal Income Withhold Manually With 19 And Earlier W4 Form

Free Tax Calculator Tax Return Estimator Liberty Tax

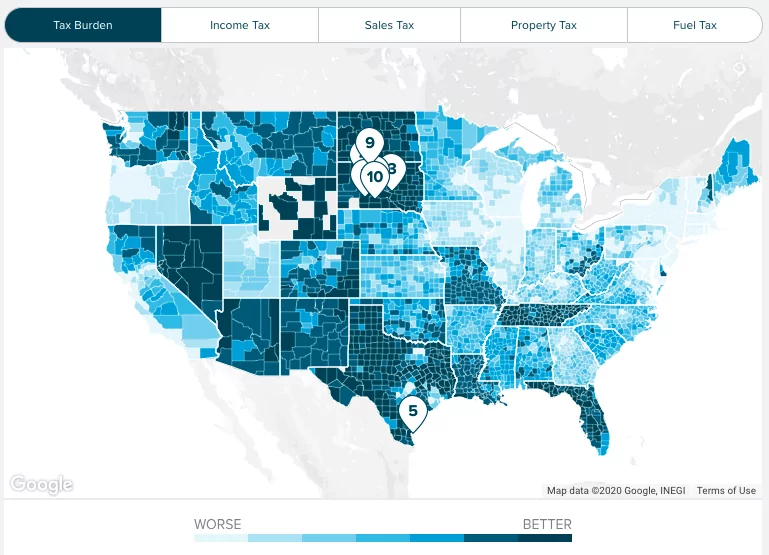

Free Income Tax Calculator Estimate Your Taxes Smartasset

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

How Will The Tax Reform Affect W 2 And 1099 Tax Filings

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Self Employment Tax Calculator Estimate Your 1099 Taxes

Top 7 Free Payroll Calculators Timecamp

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

Tax Information

Financial Calculator 1040 Tax Calculator

Walk Through Filing Taxes As An Independent Contractor

1099 Taxes Calculator Estimate Your Self Employment Taxes

Salary Paycheck Calculator Calculate Net Income Adp

21 Payroll Calculator Tax Rates Free For Employers Onpay

How To Calculate Taxable Wages A 21 Guide The Blueprint

Tax Forms For 24 Tax Returns Due In 25 Tax Calculator

How To File Quarterly Taxes In An Instant

What Is Self Employment Tax And What Are The Rates For Workest

1099 Tax Rate For 21 And 5 More 1099 Worker Tax Tips Stride Blog

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

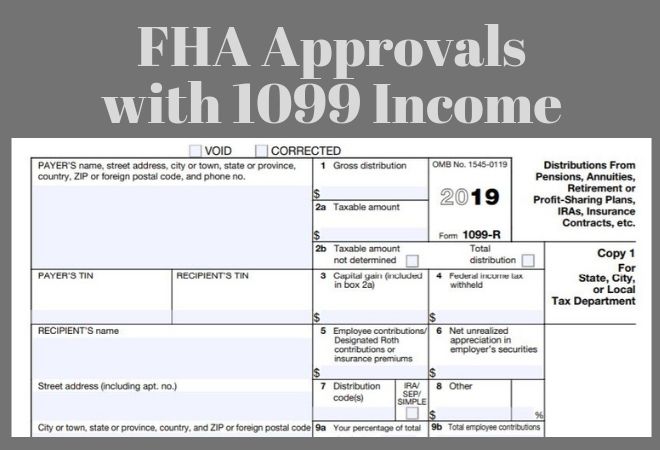

Fha Loan With 1099 Income Fha Lenders

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Free Net To Gross Paycheck Calculator

How To Calculate Federal Income Withhold Manually With New W4 Form

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Free Tax Calculator Tax Return Estimator Liberty Tax

Doordash 1099 Taxes And Write Offs Stride Blog

Walk Through Filing Taxes As An Independent Contractor

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

How To Provide Paycheck Proof When You Re Self Employed Az Big Media

Self Employment Tax Hub For 21

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Federal Income Tax Calculator Credit Karma

1099 Tax Calculator 21 Quickbooks Payroll

1099 Tax Calculator 21 Quickbooks Payroll

How To Calculate Fica For Workest

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Hourly Paycheck Calculator Business Taxuni

Tax Changes For 1099 Independent Contractors Updated For

Quarterly Tax Periods Calculating And Paying Your Share

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

Estimated Tax Payments For Independent Contractors A Complete Guide

Check Out This Overview Of Income Tax Documents And Common Mistakes To Help You Betaxprepsmart Money Smart Week Tax Refund Tax

Understanding Tax Form 1099 And The New 1099 Nec Gudorf Tax Group

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

Federal Tax Withholding Calculator Archives New York Retirement News

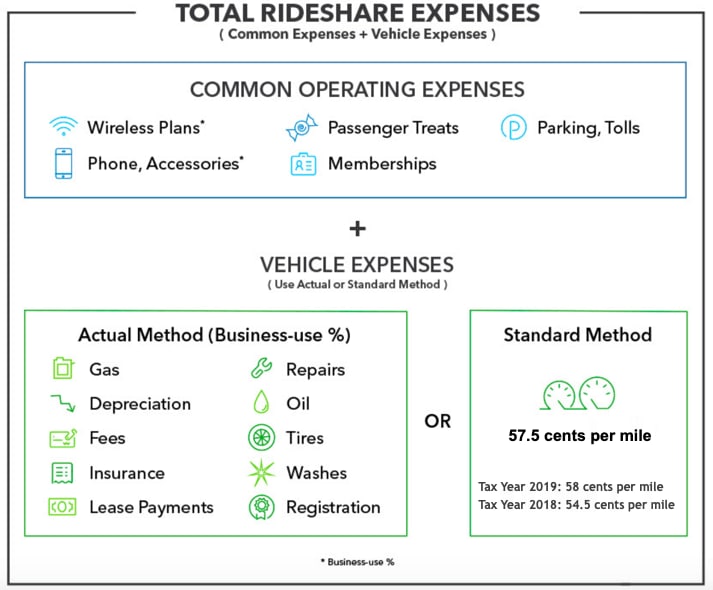

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Form 1099 Nec For Nonemployee Compensation H R Block

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

Income Tax Calculator Texas

What Is Irs Form 1099 Misc Miscellaneous Income Nerdwallet

1099 Taxes Calculator Estimate Your Self Employment Taxes

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

W 2 1099 Filer Software Net Pr Calculator

Quickbooks Payroll Calculator Salary Hourly Paycheck Calculation Tool

Paycheck Calculator Take Home Pay Calculator

Self Employment Tax Calculator 1099 Schedule C Estimated Taxes

Employer Payroll Tax Calculator Gusto

Saas Seo Case Study Increasing Hurdlr S Google Rankings 70 For 21 Strategic Keywords

Tax Withholding Calculator And W 4 Form For

1

Quarterly Tax Calculator Calculate Estimated Taxes

Tax Calculators Estimator By Tax Years Estimate Refund

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

4 Signs You Re About To Be Hit With A Big Tax Surprise Wreg Com

1099 Misc Tax Calculator

How Starting An S Corp Could Lower Your Taxes By 5 000 Tax Savings Calculator Gusto

Esmart Paycheck Calculator Free Payroll Tax Calculator 21

Free Online Paycheck Calculator Calculate Take Home Pay 21

Paycheck Calculator Take Home Pay Calculator

0 件のコメント:

コメントを投稿